Last Updated: July 2021

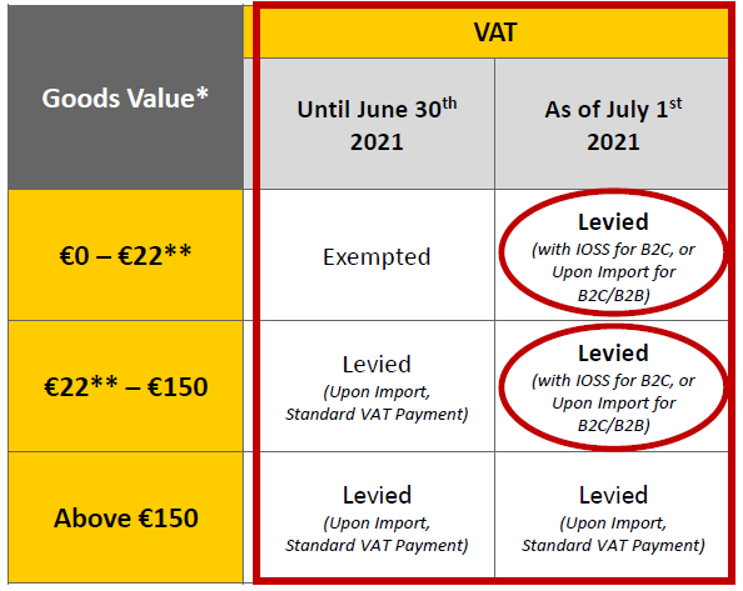

Beginning July 2021, the abolition of the 22 Euros VAT De Minimis for imports into the EU will result in formal customs clearance for all inbound EU shipments and levying VAT. The EU is aiming to level the playing field, protect its businesses and avoid unfair competition and distortion for EU companies.

This will affect all shipments to the European Union. Details are listed in the table below.

VAT Collection

Different VAT collection possibilities are available for B2C shipments up to EUR 150. To use the Special Scheme (with IOSS), as a first step the online seller must register for IOSS in one EU country. Upon registration, the seller will be given an IOSS number, which is valid for any country in the EU.

1. With IOSS (B2C): Introduces an IOSS (Import One-Stop-Shop) VAT collection model with the VAT to be collected by the seller at the moment of purchase for B2C shipments.

Companies from outside the EU with no EU representation must assign an intermediary (tax representative) to deal with EU VAT compliance on their behalf, i.e. to pay the VAT amount to the EU Tax Authority (via a monthly VAT return). This means only one EU VAT Registration (covering all the 27 EU countries ), instead of the current system which requires 1 VAT registration for each EU country in the case of DDP.

If you are IOSS registered, and the VAT is collected at the time of sales, the IOSS number has to be provided to DHL Express in the invoice data. We've created two resources that outline where to indicate the IOSS number depending on how your shipment is created.

When creating a shipment using one of DHL’s Electronic Shipping Solutions, use this resource.

When creating a shipment in PSCSHIP, reference this resource.

2. Companies without IOSS (B2C or B2B) will remain the same as the current process in place for shipments above EUR22 where either DHL pays VAT to Authorities upon import and then charges the customer (as per DHL Billing Service selected, e.g. DTP Billing Service), or the customer pays VAT directly to Authorities with its own deferment account.

New Customs Declaration Requirement

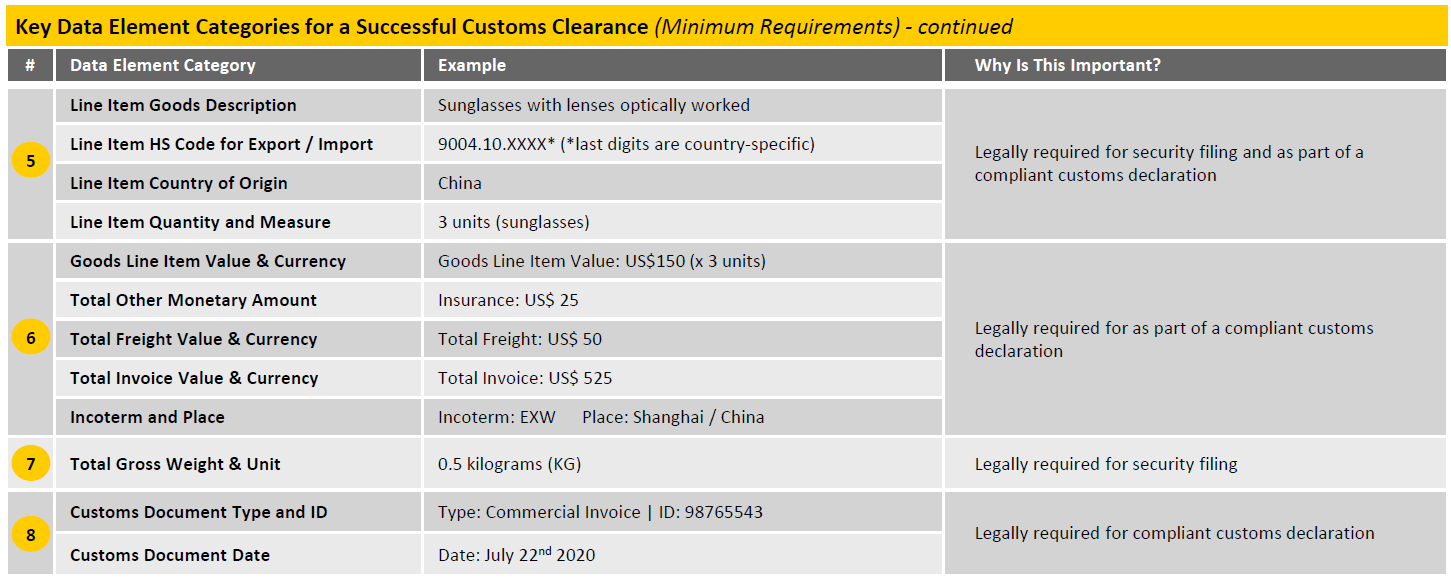

With the EU's decision to abolish the VAT relief as of July 1, 2021, all shipments imported to the EU will require a formal Customs Declaration (one per shipment). To avoid shipment delays, and successfully clear your shipments with Customs Authorities, it’s essential that you provide the following:

1. A digital copy of your commercial invoice. We have added the additional necessary fields to the commercial invoice form in PSCSHIP. This resource outlines where the additional import tax ID fields are located on the commercial invoice within PSCSHIP.

2. Complete & Accurate Goods Details and Descriptions. The details must include shipper, exporter, receiver, and importer of record address and contact information. The product description should be as descriptive and clear as possible.

3. Accurate & Itemized Values on the Invoice. This includes a line item goods description, HS Code, country of origin, and quantity and measure. Example: Sunglasses with lenses optically worked, 9004.10.XXXX (last digits are country-specific), China, 3 Units.

Examples and further information on goods descriptions can be found below:

It is important that you include the HS Code for Exports and Imports. DHL is running an audit on these codes and will provide additional information to those who will run into issues.

The following resource includes additional invoice guidelines related to specific topics like gifts, repair & return, and multi-piece shipments. Please reach out to your account representative with any specific questions.

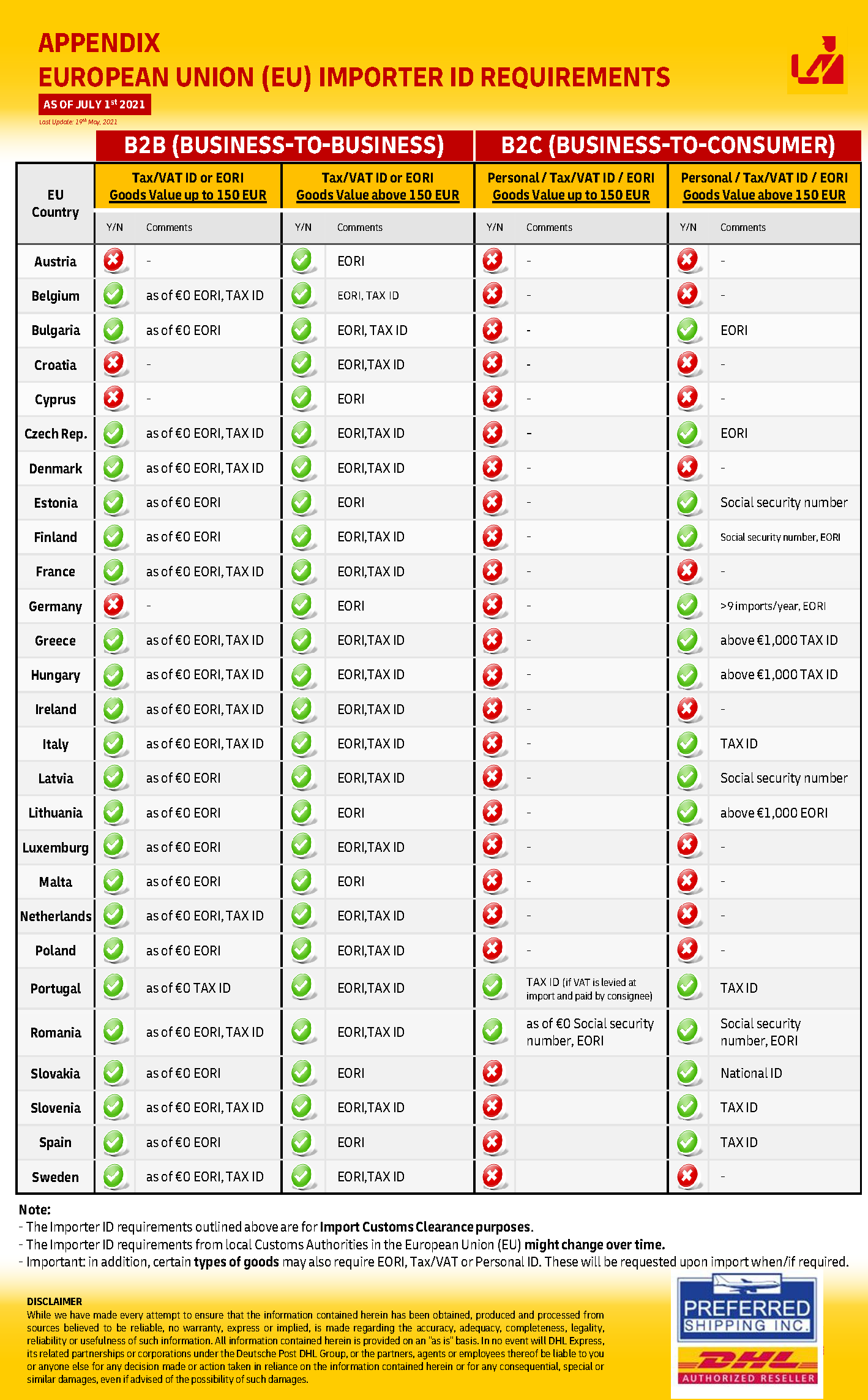

EU Importer ID Requirements

Impact for Receivers

As of July 1st, all commercial goods imported into the EU will be subject to VAT and will require a formal customs declaration. DHL will support receivers by taking care of:

- All customs clearance formalities

- Providing receivers with an easy VAT payment solution

EU Receivers:

If you need to pay VAT (or other associated Customs charges):

- If you already have a DHL account: DHL will bill your account.

- If you do not have a DHL account: DHL will send you a link for payment to be made online – please make the online payment as soon as possible to ensure smooth delivery of your shipment.

If the VAT (or other associated Customs charges) were already paid (i.e. the purchase price already included VAT), no further payment will be needed from your side.

If you have been asked to pay VAT (or other associated Customs charges), but are expecting a shipment without payment of VAT (or other associated Customs charges) at import, please contact your shipper/seller of the goods for clarification. Some examples might include:

- Shipper has not included VAT amount as part of the purchase price.

- Shipper has not provided the correct information to DHL such as correct goods value.